Venture building is an innovation strategy that could have saved many industry-leading corporations from being replaced by more competitive startups and businesses.

Take BlackBerry for example. It once dominated the cellphone manufacturing industry, with over USD 15 billion in revenue in cellphone sales alone during its peak in 2011 according to data from Statista. But just 4 years later, Statista’s data shows that the company did not have any revenue from the sale of its cellphones.

The former phone manufacturing giant seems to have all but disappeared. CNN reported that BlackBerry still stuck to making phones with physical keyboards when the consumer market was shifting toward the touchscreen phones such as the phones Apple and Samsung made.

It seems that its competitors were able to innovate and react to market shifts faster and better than BlackBerry. Business Insider reported that the company failed to innovate, leading to the demise of its cellphone manufacturing business.

Many other established and seemingly failure-proof businesses have gone down the same path. This highlights the need for all businesses, including current industry-dominating corporations, to innovate in order to stay ahead of their competition and be relevant to their customers.

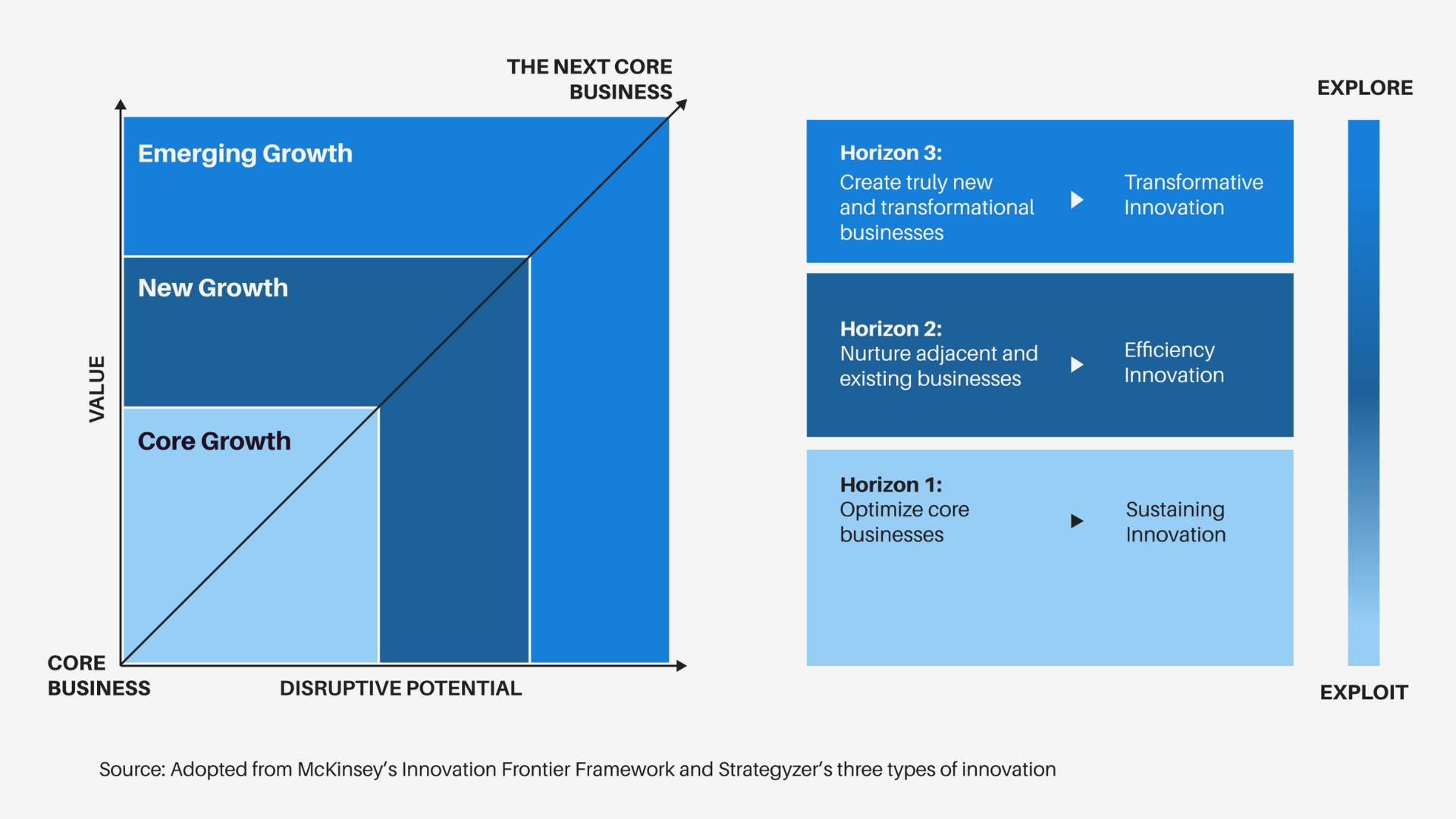

These innovations need to be able to create new streams of revenue, make a company more competitive on the market, enable a business to adapt to rapid change, and stimulate new growth – things that corporate venture building does for venturing organizations.

What Is Corporate Venture Building (CVB)?

Corporate venture building (CVB) is a proven innovation strategy that allows organizations to stimulate new long-term growth through the creation of new avenues of revenue and growth. These new avenues of growth could come in many forms including new products, services, brands, business models, and independent business entities.

Ventures are often built to serve markets and customer groups that the venturing organization’s core business doesn’t serve – providing a new avenue for growth for the entire organization.

For example, a corporation whose core business is in telecommunications can build a venture in the completely different fintech space. Businesses may also build new ventures within the same industry and market as their core business to complement their existing products and services.

Newly created ventures can operate as their own independent business, with their own workforce, offerings, and business model. However, many ventures remain integrated with the core business of the venturing organization.

Not all organizations have the expertise necessary to innovate and build a venture successfully, which is why some seek an experienced corporate venture building partner.

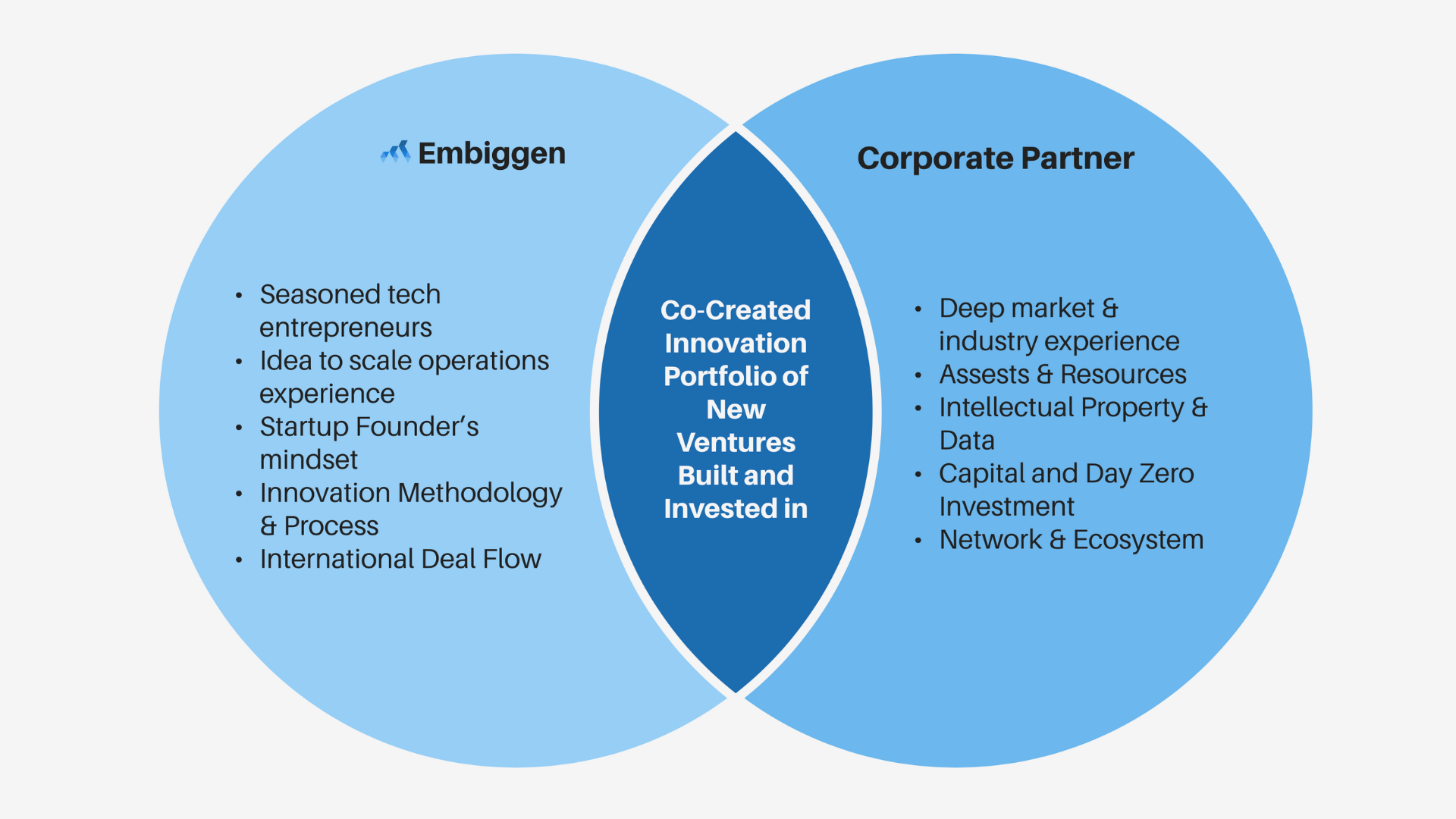

Under the Embiggen Group’s corporate venture building model, a venturing organization and Embiggen Digital Ventures form a strategic partnership – with both sides bringing their strengths onto the table.

The venturing organization partners with Embiggen to act as a co-founder of a venture. Embiggen brings the expertise needed to design, build, and scale the venture. On the other hand, the venturing organization brings their deep industry experience, investment capital, and wide network to enable the creation and success of a venture.

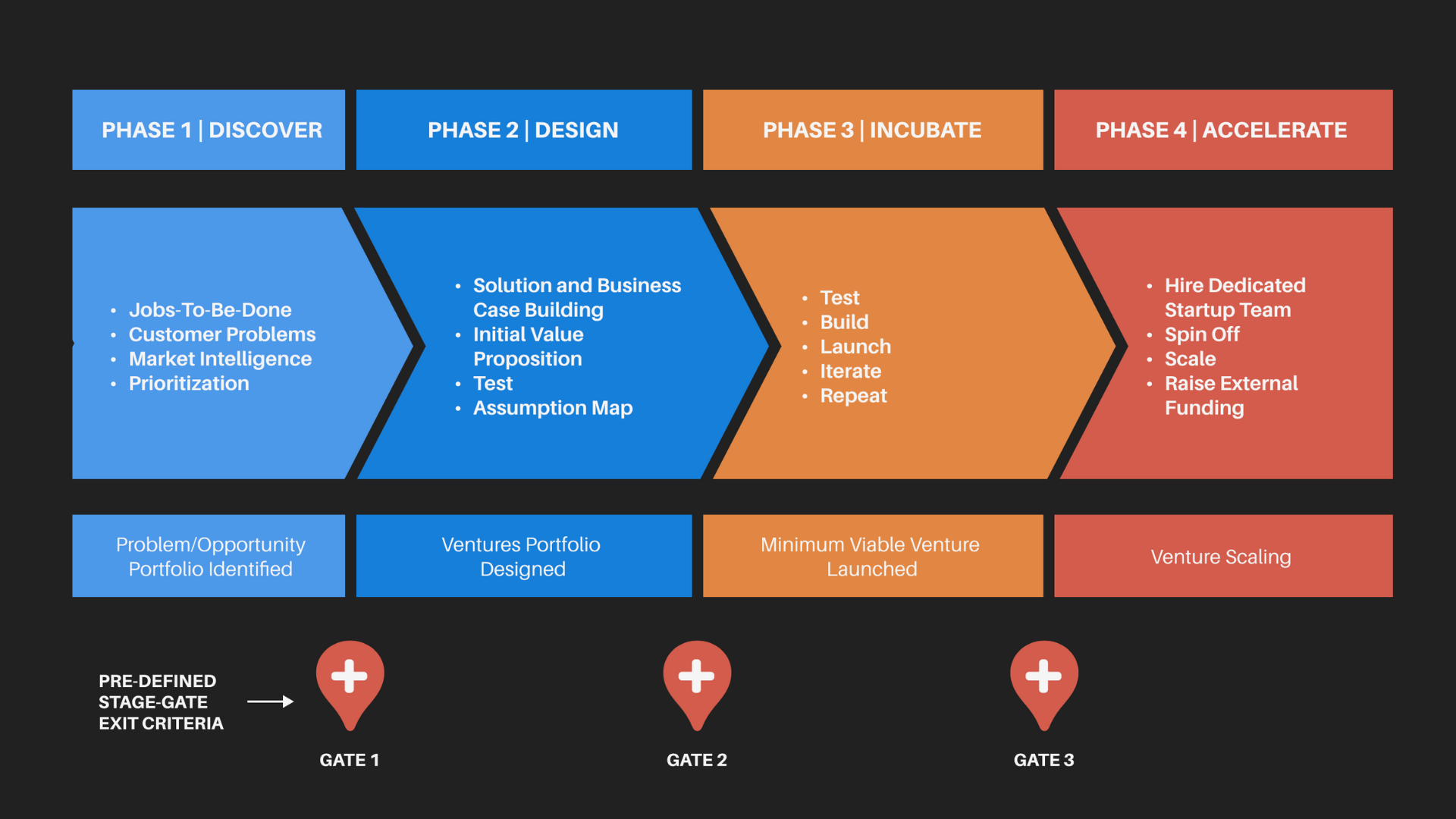

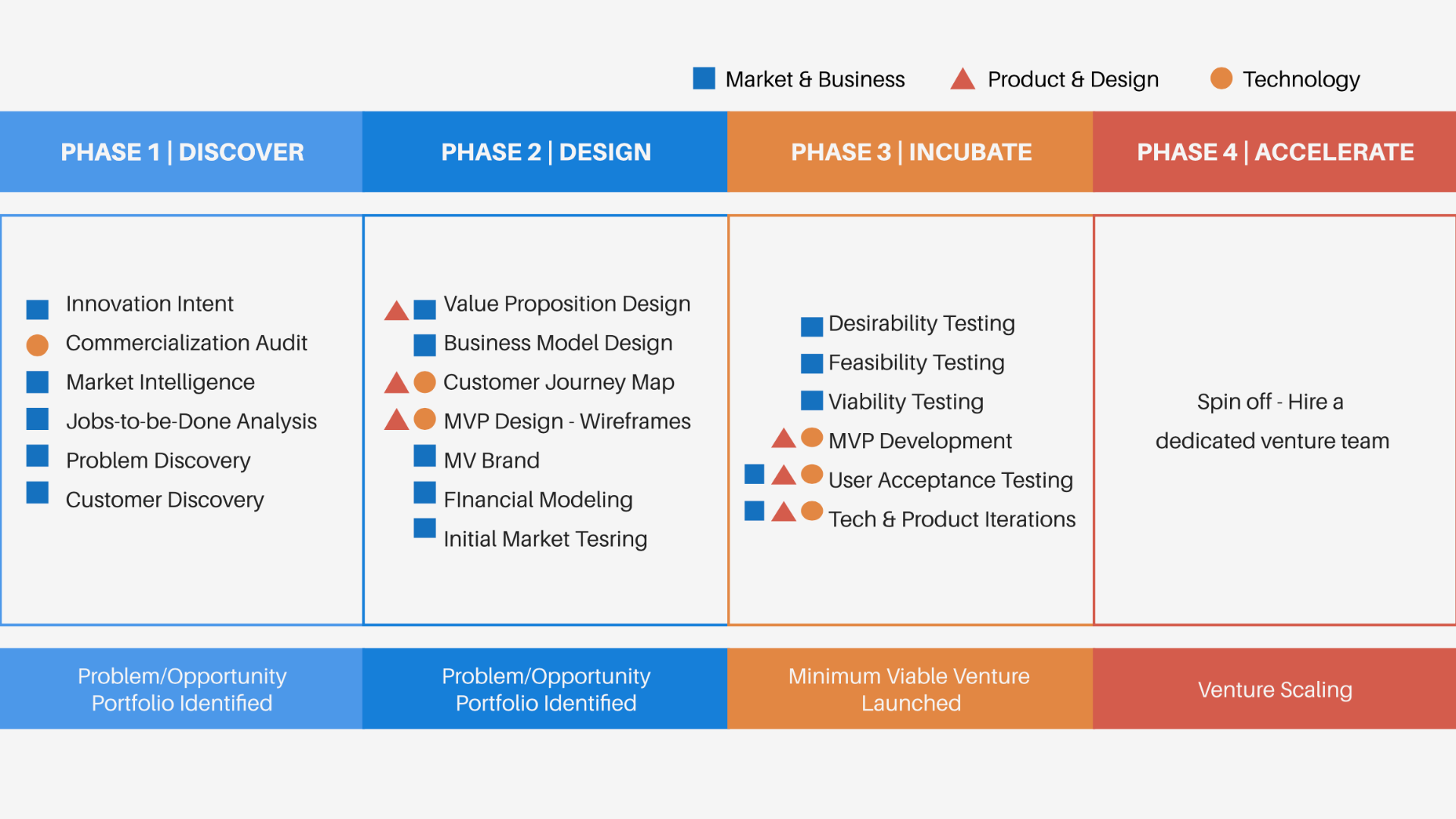

Embiggen’s 4-Phase Venture Building Process

The process of building ventures is similar to creating a new startup however, the goals are slightly different.

Venture building and building startups share the same goal of building something new. But under venture building, the ultimate goal is to diversify the offerings of a venturing organization and create a new revenue stream for the organization.

Here’s a peek at the venture building process that Embiggen Digital Ventures, the Embiggen Group’s corporate venture building arm, uses.

‘Discover’ problems worth solving

As all innovations need to solve a problem in order to be successful, the venture building team starts by discovering unsolved problems. Each of these problems may be an opportunity for the venturing organization to innovate and solve.

The opportunity to innovate may come from anywhere. To find these opportunities, the venture-building team can use a variety of research tools and methods. Some examples are the business opportunity map, environmental analysis, and futures research.

While there are many opportunities to innovate, not all are appropriate opportunities for the venture to solve. The venture-building team must identify a problem that the venturing team can solve and has high demand to be solved.

Once the venture team finds a few problems worth solving, the team needs to confirm that there is demand in the market for a solution. Furthermore, the team needs to do additional research to identify the value the solution can bring to the company and the potential market size for the solution.

The team can now take the problems that pass these criteria into the next phase.

‘Design’ solutions to address selected problems

Under this step, the venture building team starts to create business cases and design solutions to the problems they identified in the previous phase.

The team uses typical product design development tools such as ideation sessions and innovation sprints. They will also develop the value proposition and business model of the venture, alongside the development of the solution.

At this phase, it is important to keep going back to the core problem and the purpose of the innovation or venture to check if the ideated solutions are capable of solving the problem.

Many innovators, particularly at this stage of venture building, ‘fall in love’ with the solutions they make which puts them at risk of forgetting the problem they set out to solve. They may become jaded and falsely believe the design of the solution is more important, even if it doesn’t solve the problem efficiently and effectively.

Thus, the team must always check for problem-solution fit in order to create a solution that best solves the problem at hand.

Once the team selects a business case and solution, the team can move on to the next stage.

Get the latest innovation news and exclusive event invites direct to your inbox. Subscribe to our newsletter!

‘Incubate’ the solution to the problem

At this point, the team starts building the minimum viable prototype of the selected solution and begins to test it with consumers. The ‘Incubate’ stage determines the viability of the created solution in the market. It also validates whether or not a solution solves the customer’s problem and how good it is at solving this problem.

The venturing organization iterates and improves this prototype repeatedly based on the feedback from consumers and the learnings they gathered from tests. Iteration is necessary in order to de-risk the product and work out any problems that the tests identify. With each iteration, a solution must become more effective at solving a problem and more attractive to consumers.

By the end of this stage, the venture building team should have created a market-ready solution that paying customers can purchase and use.

‘Accelerate’ the venture into its own business

Lastly, at the accelerate stage, the venture team can now launch their newly-created venture in the wider market as a fully market-ready solution.

The venture starts building its own dedicated team for further product development, sales, marketing, service delivery, and more. It is also at this final stage when the venture starts selling the product to the market and generating its own revenues.

As this process goes on, the newly created venture will rely less and less on the support and resources of the venturing organization. It will start looking more and more like a standalone business.

For the newly built venture, this phase goes on indefinitely as it grows and potentially even dominates the market. But what happens to the venture building team after this? They repeat the whole process of finding a new problem, creating a solution, and building a new venture all over again.

What Can Venture Building Do For My Organization?

Building new ventures has the potential to bring significant benefits to both the venturing corporation and the newly created venture.

Paul Genberg, Head of Product of Shell’s corporate venture builder StudioX, claimed that the corporate venture building strategy is the fastest path to innovation.

Genberg wrote in a Forbes article that “investing in a CVB for your company could lead to an explosive wave of growth, industry-disrupting innovation, and rapid introduction into a new market.”

As businesses create ventures with the explicit goal to scale them into self-sustaining products, brands, or businesses, corporate venture building has a strong potential to significantly contribute to an organization’s bottom line.

Furthermore, these ventures allow an organization and the venturing corporation to enter, serve, and access new markets, industries, and consumer segments. Ventures also diversify the portfolio of products and services an organization offers.

Ventures may even disrupt other companies that are currently in the market.

On the other hand, the newly created venture may benefit significantly from the support it has from the venturing corporation.

A corporation’s newly-built business venture is more competitive than a traditionally-made startup because it combines the best of both the startup and corporate worlds. Ventures have both the nimble and innovative culture of startups and the vast amount of resources that the venturing corporation has.

Comparatively, startups typically have the same innovative mindset and culture but have to rely on their own often smaller pool of resources. This may make innovation slower if their innovation initiatives are resource-intensive.

Thus, ventures have the potential to grow faster and develop their innovations quicker than similarly mature startups solely because of their access to resources.

Globe’s fintech venture GCash is one of the best examples of what a newly built venture can do for an organization.

Venture Building Success Stories: The Rise and Domination Of GCash

Globe Telecom, Inc’s corporate venture building arm 917Ventures built GCash. While telecommunications is Globe’s main industry as one of the Philippines’ largest telecommunications providers, GCash is its successful venture into the fintech industry.

The fintech platform offers various digital payment and finance solutions.

Just under 2 decades after its establishment in 2004, GCash has achieved double unicorn status with an estimated value of over USD 2 billion in November 2021. Over 60 million users utilized the fintech platform a day, with a peak of 19 million transactions in 2022.

It perfectly exhibits the full potential of corporate venture building. The numbers above contribute significantly to the bottom line of Globe’s organization and provided Globe with a new avenue of growth outside of the telecommunications industry. Through GCash, it accessed a new market and industry – the fintech world.

Beyond contributing financially to its organization, GCash has helped more Filipinos access financial services, in a country where only 51% of the population had a bank account according to a 2021 BusinessWorld report. It has significantly improved financial access in the country, signifying its impact on the communities it serves in the Philippines.

GCash is far from the only venture that has had a significant impact on society.

Venture Building for Good: Shell’s StudioX For A Sustainable Future

StudioX is Shell’s corporate venture builder tasked with innovating Shell’s energy business for a sustainable future. SixLab, a startup studio, is among the ventures it has built.

It supports and invests in startups focused on innovating the energy industry. Through its accelerator program, it hopes to build the ideas of startups into commercially viable products that will revolutionize energy. Among others, it is supporting the development of green energy and emissions management solutions.

This is just one case of using CVB to create a better tomorrow. Through its efforts, SixLab is helping to ensure that the future of energy is greener and sustainable.

Get the latest innovation news and exclusive event invites direct to your inbox. Subscribe to our newsletter!

Build new ventures with Embiggen Digital Ventures

Embiggen Digital Ventures is ready to be your external corporate venture builder. If you have an idea, let’s co-create it.

Our team has decades of combined startup and corporate experience, giving us the unique ability to build ventures at startup speed. Our team’s hyperlocal understanding of startups, venturing, and emerging markets puts us in a unique position to diversify and future-proof your organization.

Do you fear your current core product or service won’t last? Are you struggling to find new ways to grow your organization?? We will help you break these barriers.