One of the greatest venture building success stories is GCash, one of the most popular mobile wallets in the Philippines.

The fintech platform had over 66 million users by the second quarter of 2022, a figure that’s around 83% of the adult population of the country according to data from Statista.

It recorded a gross transaction value of Php 3 trillion in the first six months of 2022. By the end of 2022, it is likely to surpass the Php 3.8 trillion gross transaction value recorded in the whole of 2021 by double.

“We now see an increased use of mobile wallets as people embrace e-commerce. With GCash, the unbanked and underserved population are finally empowered. They can already do so much more, such as paying for their online purchases without a credit card or a bank account, getting health insurance, and investing in Unit Investment Trust Fund,” said GCash President & CEO Martha Sazon in a press release.

The wide variety and popularity of GCash’s products and services helped its parent company, Mynt, achieve a valuation of $2 billion in 2021.

But how did the Philippines’ largest telecommunications company build the fintech platform into the country’s first double unicorn?

Get the latest innovation news and exclusive event invites direct to your inbox. Subscribe to our newsletter!

The Early Days Of GCash’s Corporate Venture Building History

Mobile banking in the Philippines started back in 2000 when Smart Communications, Inc. introduced Smart Money – a service where Smart subscribers could link their phones to a bank account.

Smart Money launched its Smart Padala feature in 2004, which allowed users to send money via text and withdraw using their local remittance partners. It was the world’s first mobile phone-based international cash remittance service, used by over 10 million Overseas Filipino Workers to send cash to their families in the Philippines.

This is where GCash’s story begins.

Smart competitor Globe Telecom, Inc. built GCash in 2004, through its wholly-owned subsidiary G-Xchange Inc., as a competitor to Smart Money and Smart Padala.

GCash is a mobile wallet where users make payments and receive cash through SMS. It was the telecommunications company’s first venture into the fintech industry.

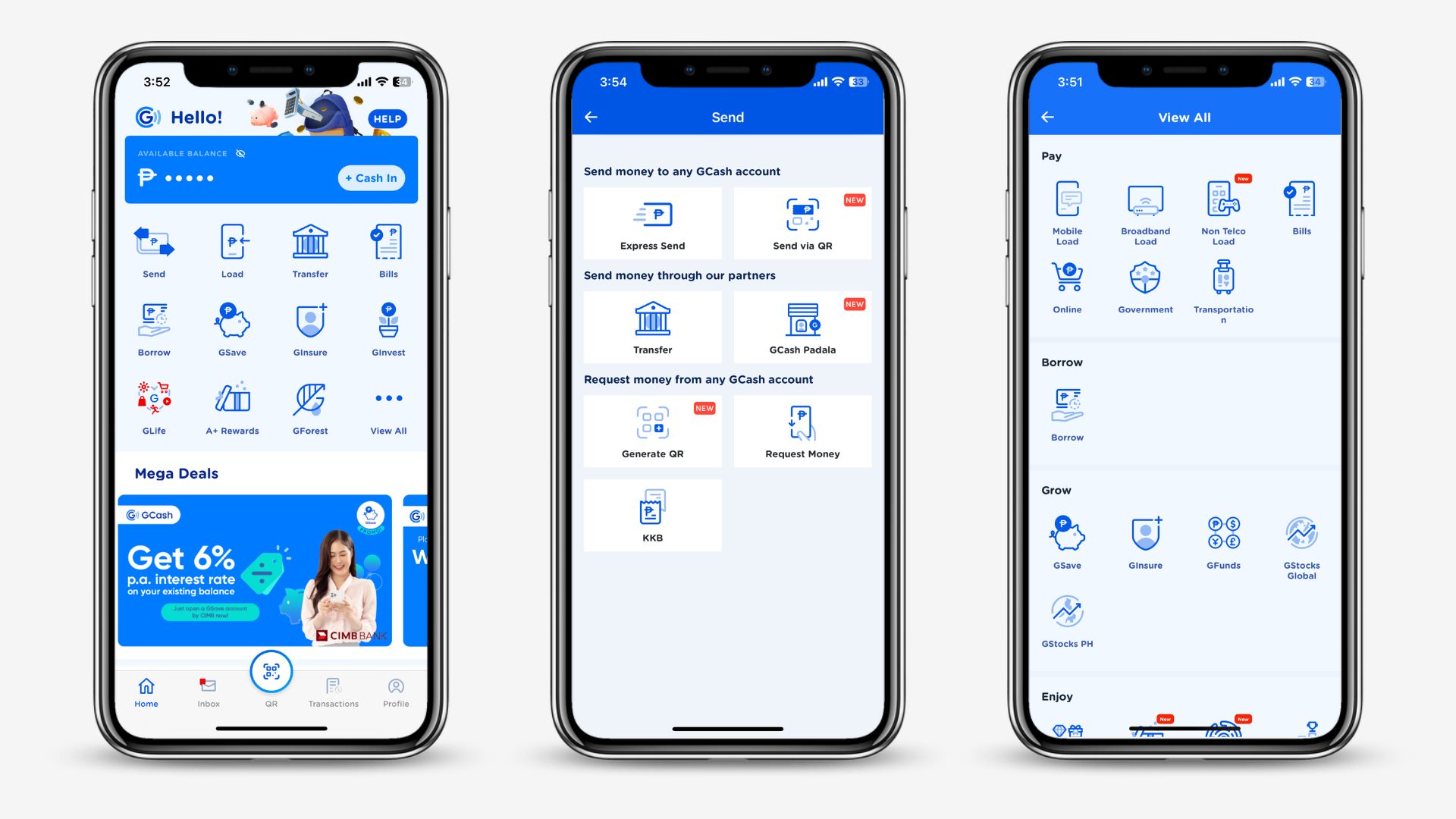

This is how GCash worked back in 2004:

- To fund a GCash account, a user could receive cash locally or internationally from someone else via SMS.

- They could also send money to their account through cash-in & cash-out partners and ATMs in the country in 2010.

- People can then use the money stored in the account in several ways including paying for food in restaurants, cashing out via a local payment partner, transferring to a bank account for ATM withdrawal, and remitting cash locally or internationally.

However, in 2006, GCash’s 1 million users were only a fraction of Smart Money’s 7 million users. In 2007, GCash’s $19.7 million transaction volume was minuscule compared to Smart Money’s $1.3 billion.

So how did it overtake Smart and grow into the premiere mobile wallet in the Philippines?

A Successful Fintech Corporate Venture Building Case Study: Globe’s GCash

Unlike Smart Money, GCash was fully digital. Smart Money users had to avail of a linked Mastercard debit card to pay merchants but GCash users could do so fully digitally via SMS.

This meant Smart Money relied on pre-existing banking infrastructure like ATMs and POS machines which were not prevalent in rural areas of the Philippines. GCash, on the other hand, just needed Globe’s telecommunications infrastructure which already had a wide reach in the country.

This allowed GCash to scale rapidly and reach more customers than Smart Money.

Furthermore, between GCash and SMART Money, GCash was the first to introduce a mobile app in 2012 making the service more convenient for its users.

Instead of memorizing and texting long codes and keywords, now users could just tap on their smartphone to pay bills, send money, load their accounts, and more. The app was very similar to what we have today, albeit with much fewer functions.

This convenience and accessibility were key to capturing the market, especially during the pandemic when many people preferred digital payments over cash and card.

GCash’s QR code-based payment service further made the payment platform more convenient.

The result?

The QR code service helped triple the transaction value of GCash and double its users in 2018.

And in the second quarter of 2022, over four out of five adults in the Philippines had a GCash account or roughly 66 million users. 5.2 million merchants and social sellers accepted payments from the platform in the same period.

Other GCash Features (As Of July 2023)

- Open a savings account with partner digital banks.

- Avail of travel, life, accident, and pet insurance policies with partner providers.

- Pay government fees and utility bills.

- Invest in Philippine stocks and UITFs.

- Buy and sell cryptocurrency.

The company has been attractive to investors worldwide. An investment by Bow Wave Capital in Mynt, GCash’s operator, brought the fintech platform’s valuation close to $1 billion in early 2021.

Its valuation doubled in the same year.

An investment by Warburg Pincus, Insight Partners, and Bow Wave Capital further brought its valuation to $2 billion, making it the country’s first double unicorn.

What Can Other Companies Learn From GCash’s Success?

GCash owes its growth and success to Globe Telecom, Inc.’s subsidiaries G-Xchange, Inc., Globe Fintech Innovations, Inc. (Mynt), and Globe’s venture builder 917Ventures.

The fintech platform is, by far, the greatest venture building success of Globe. It allowed Globe, a major telecommunications player, to enter the fintech market – a market that complemented and benefitted from its main business immensely.

It created a new stream of revenue for Globe, alongside a large library of innovative financial products and services — giving Globe a new avenue of growth in a completely new industry.

However, if another company wants to create a similar radical innovation success story as GCash, it’ll have to put in the work. And this goes beyond just having venture building expertise.

Get the latest innovation news and exclusive event invites direct to your inbox. Subscribe to our newsletter!

Probably the most important milestone in GCash’s history was that it was able to sort through the noise and correctly identify future cashless payment trends. And it was able to identify these trends years before its competitors were able to — possibly thanks to strategic foresight and its potential to reveal hidden trends and opportunities.

Building this capability is crucial for any business that wants to build tomorrow’s greatest products and services.

Mynt and Globe also continuously iterate and upgrade the app based on customer demands and feedback — making it even more customer-centric as time goes on. While the pandemic most likely sped up the app’s adoption in everyday life, these iterations are necessary for the app’s long-term growth and survival.

Over the years, it has gone beyond being a simple e-wallet app and payment platform, with GCash offering savings accounts, investment products, insurance policies, loans, and more together with its partners.

These additional services give GCash, and by extension Globe, even more room to grow in different business verticals and to future-proof the app against upcoming crises and disruptions.

Thus, businesses that want to build success stories just like GCash need to look toward what their customers will want or need to buy in the future and design their new offerings in line with these — of course on top of having the capability and resources to do venture building.

Embiggen Digital Ventures: Co-create The Next Big Thing

Want to recreate its venture building success but don’t have your own venture builder like Globe did?

Embiggen Digital Ventures is Embiggen’s corporate venture building (CVB) arm. It co-creates new ventures with corporations worldwide, backed by our team of innovation experts and venture capital leaders.

Typically, newly built ventures create new revenue streams for an organization while operating independently of the core business. These ventures also allow corporations to access untapped markets, cater to consumers’ unsolved problems, and diversify their offerings.

Learn more about the work Embiggen does here or schedule a FREE 30-minute strategy session with our experts here.