What works for businesses today may not work for them in the next few years – which is why venture building has proven to be a popular solution in recent years for organizations to safeguard their future.

This is true for all businesses whether big or small. An unforeseen crisis can happen tomorrow and halt all of a business’s operations, similar to what happened during the pandemic.

More commonly, a more agile startup could pop up out of nowhere. Its more innovative offerings will most likely eat into the market share of the leading corporation in its industry. This story ends with the startup eventually replacing the corporation as the market leader.

Because of these, businesses cannot rely on their current line-up of products and services forever. Why? Your current offerings are most likely bound to become irrelevant or obsolete. The current market conditions require all businesses to innovate by creating new products and services or by improving their current offerings.

This is where venture building can help.

What Is Venture Building?

Venture building is a proven innovation strategy that aims to stimulate exponential long-term growth in organizations by creating new avenues of revenue and growth. Ventures come in many forms including new products, services, brands, business models, and independent business entities.

The strategy’s ultimate goal is to diversify an organization’s portfolio of offerings, hit growth targets, and increase an organization’s bottom line.

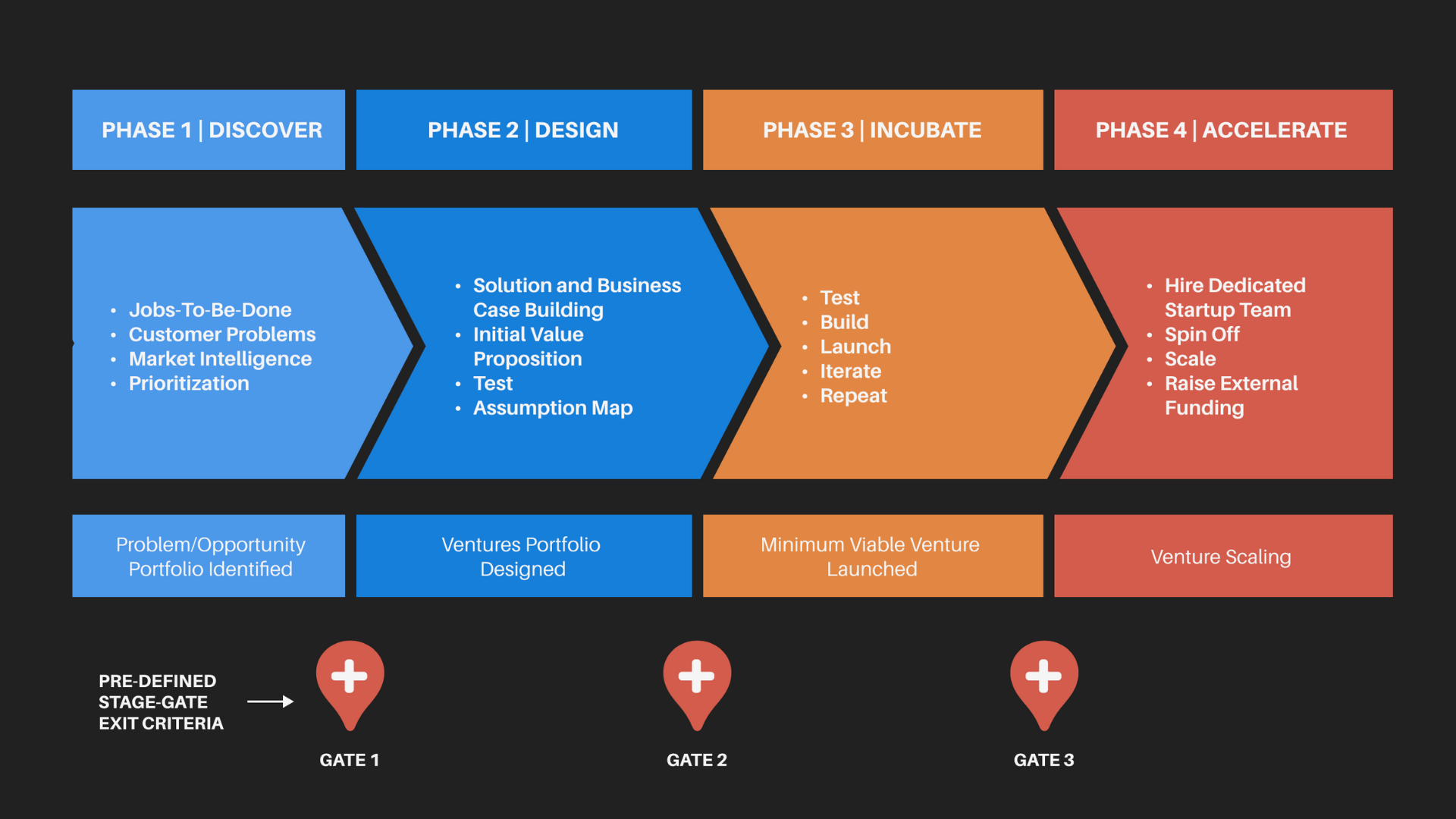

To build new ventures, an organization identifies an unsolved problem or an opportunity to innovate within markets it currently doesn’t serve or industries it isn’t involved in. However, organizations can also build new ventures within the markets and industries it is in right now.

Once it identifies a problem that the market wants to be solved, an organization can start building the new venture. Throughout the process, a venturing organization will iterate prototypes and scale the venture to be a market-ready offering ready to disrupt its competitors.

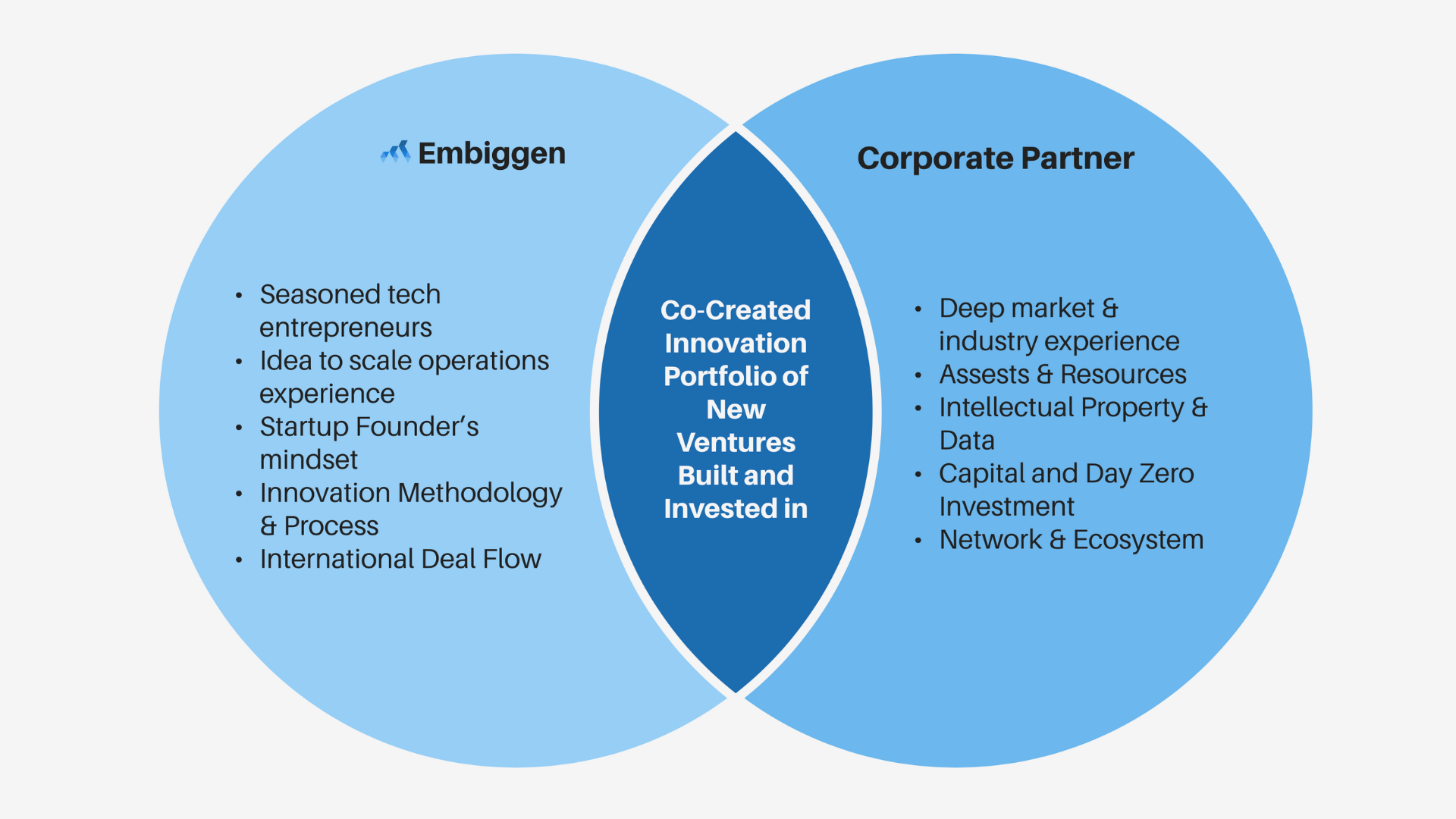

Because not all organizations have in-house entrepreneurs or the capability to build new ventures, they often partner with an external corporate venture builder to be the co-founders of their new ventures.

What Can Venture Building Do For Your Organization?

1. It can create a new ‘core business’ for your organization.

Newly built ventures can take the form of a small business, similar to a startup, which is why they may not contribute much to an organization’s bottom line.

However, through the establishment of these new ventures, a venturing organization can access new markets and diversify its current offerings. When an organization inevitably scales its venture, an organization stands to gain a lot from the new markets it entered and the new products and services it made through the venture.

At a certain point in a venture’s growth, it’ll begin relying less on the organization’s financial backing and relying more on its own profit. The venture will start looking and acting as its own independent business.

It is also at this point that the venture will start significantly contributing to the bottom line of the venturing organization. Thus, the venture can now be an organization’s new ‘core business’ that is completely separate from its main business.

This new ‘core business’ makes an organization more competitive and resilient to crises as the organization no longer has all its eggs in one basket. Even with just one successful venture, an organization will have access to at least two markets, a more diverse portfolio of products and services, and a lesser probability of a complete failure of the organization.

2. It is the fastest and most effective path to corporate innovation.

Many major businesses today that seem like they started independently as a startup, are actually ventures co-created by established corporations and corporate venture builders. These ventures fully illustrate how effective corporate venture building is at innovating an organization and increasing an organization’s bottom line.

One well-known venture is GCash, a fintech platform that Globe Telecom Inc.’s corporate venture builder 917Ventures built. Globe Telecom Inc. is one of the Philippines’ biggest telecommunications providers.

GCash is Globe’s foray into the Philippine digital banking and e-commerce markets. It offers consumer financial services such as savings accounts, investments, insurance policies, and money transfers.

Get the latest innovation news and exclusive event invites direct to your inbox. Subscribe to our newsletter!

Furthermore, it allowed Globe to diversify its activities by entering a new market, e-commerce, and online banking. The fintech platform allowed Globe to dominate a new market in the Philippines, outside of its main telecommunications market, in a short timeframe.

GCash reported over 60 million users and a peak of 19 million transactions a day in 2022, just 18 years after Globe established it in 2004. It rapidly grew from a small business being worth over USD 2 billion in under two decades of existence, CNN Philippines reported.

3. It can build solutions to the world’s most pressing problems.

Innovation is always grounded in solving a problem. The world has plenty of pressing problems, such as education gaps, climate change, poverty, and inaccessible mental health services.

By solving problems, newly built ventures have the potential to positively impact the communities they work for.

For example, the fintech innovation GCash enhanced the access of Filipinos to financial and banking services, in a country where only half the population owns a bank account.

Shell’s corporate venture builder StudioX is creating products that accelerate the pace of innovation in the energy industry. The venture builder built SixLab, an accelerator program that supports startups involved in creating green energy and emissions management solutions.

These two ventures prove that corporate venture building has a strong potential to create a positive social impact.

Any organization can build new ventures to make the world a better place to live in. Learn more about how you can start innovating through corporate venture building with Embiggen Digital Ventures.

Embiggen Digital Ventures: Co-Create The Next Big Thing

Embiggen Digital Ventures is Embiggen’s corporate venture building (CVB) arm. It co-creates new ventures with corporations worldwide, backed by our team of innovation experts and venture capital leaders.

Typically, newly built ventures create new revenue streams for an organization while operating independently of the core business. These ventures also allow corporations to access untapped markets, cater to consumers’ unsolved problems, and diversify their offerings.

Schedule a strategy session with our team of experts and let’s build meaningful growth.

Get the latest innovation news and exclusive event invites direct to your inbox. Subscribe to our newsletter!